What are you wasting money on?įor this challenge, I narrowed it down to just three variable spending categories that I managed with cash: Now that you have a list of your budget categories, you want to identify the ones where you think you have the most room for improvement. Decide Which Categories Are Best for Cash Spending I use two online budgeting tools to track my spending ( Mint and Personal Capital), so all I had to do was log in to see a list of my major expenses.ĭon’t worry about separating fixed and variable expenses for this step.

Next, make a list of where your money is going. If this seems a bit too extreme, stash the cards somewhere else - just don’t leave them in your wallet! 2. I put the cards in a Ziploc bag, submerged the bag in a bowl of water and stuck it in the freezer. The first thing I did was freeze all but one of my credit cards to limit the temptation to use them. Here’s the 7-step plan I followed to make budgeting with cash work: 1. Let me be clear: There’s nothing wrong with the old-fashioned way! I just wanted to make it more practical.įor years, I’ve put nearly all of my expenses (groceries, restaurants, clothing, gas) on credit cards for the rewards and pay them off in full, so switching to cash was an adjustment. However, I made a few simple tweaks to make the system easier to follow in a digital world.

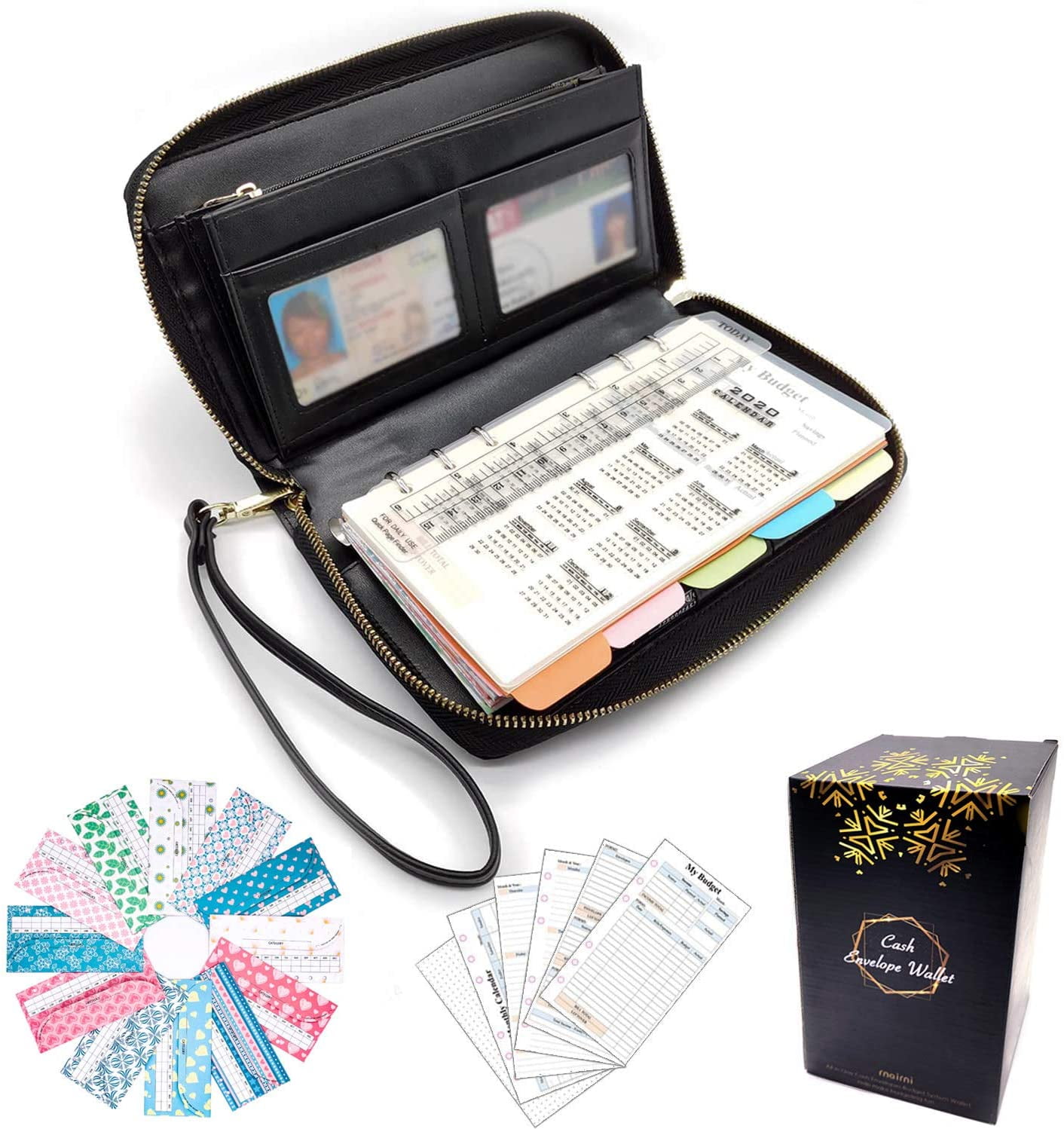

I decided to test out the cash envelope system, which is also known as the envelope method.

Is that really true? Budgeting With a Cash Envelope System We’ve all read the studies that say people spend more when they pay with plastic instead of cash. If you’re trying to get out of credit card debt, managing your money using a cash envelope system is something money expert Clark Howard has recommended for years.

0 kommentar(er)

0 kommentar(er)